Trading Commodity CFDs

Commodity CFDs are contracts for difference that allow traders to speculate on the price movements of various commodities without having to own the underlying assets. Commodities are physical goods that are typically traded on global markets, such as oil, gold, silver, and agricultural products like wheat and corn.

Trading commodity CFDs involves buying or selling contracts that represent a certain quantity of the underlying commodity, with the profit or loss being determined by the difference in price between the opening and closing positions.

Here are some key points to consider when trading commodity CFDs:

- Understanding the underlying commodity: It is essential to understand the commodity you are trading, including its market dynamics, supply and demand factors, geopolitical events, and economic indicators that affect its price.

- Risk management: Trading commodity CFDs involves risk, and traders should always consider using risk management tools such as stop-loss orders, take-profit orders, and limit orders to minimise potential losses and lock in profits.

- Leverage: Commodity CFDs typically offer leverage, which means that traders can control a larger position than their initial investment. While leverage can increase profits, it also magnifies losses, and traders should always be mindful of the risks.

- Market analysis: Successful trading requires a sound understanding of market trends and analysis. Traders should use technical and fundamental analysis to identify potential trading opportunities, as well as stay up-to-date with news and events that may affect commodity prices.

- Trading strategies: There are various trading strategies that traders can use when trading commodity CFDs, including scalping, swing trading, and position trading. Each strategy has its own benefits and risks, and traders should choose a strategy that aligns with their trading goals and risk tolerance.

- Commodity-specific considerations: Each commodity has its unique characteristics that traders should consider when trading CFDs. For example, the price of oil can beaffected by geopolitical events and supply disruptions, while gold is often viewed as a safe-haven asset during times of economic uncertainty.

Why trade Commodities with Golden Elephant ?

Trade with leverage

Commodities are traded on margin – choose your preferred leverage up to a 500:1* maximum

Competitive spreads

We give you tight, competitive spreads across our full range of commodities

Fast trade execution

Low latency and efficient price feeds mean you enjoy quick trade execution

Lower trading cost

Compared to other instruments commodities attract a much lower cost, so you trade with less expense

Trade across devices

Our mobile ST5 trading platforms allow commodity trading across your preferred devices

Trade long and short

You can take long or short positions on commodities as you only trade the price movements

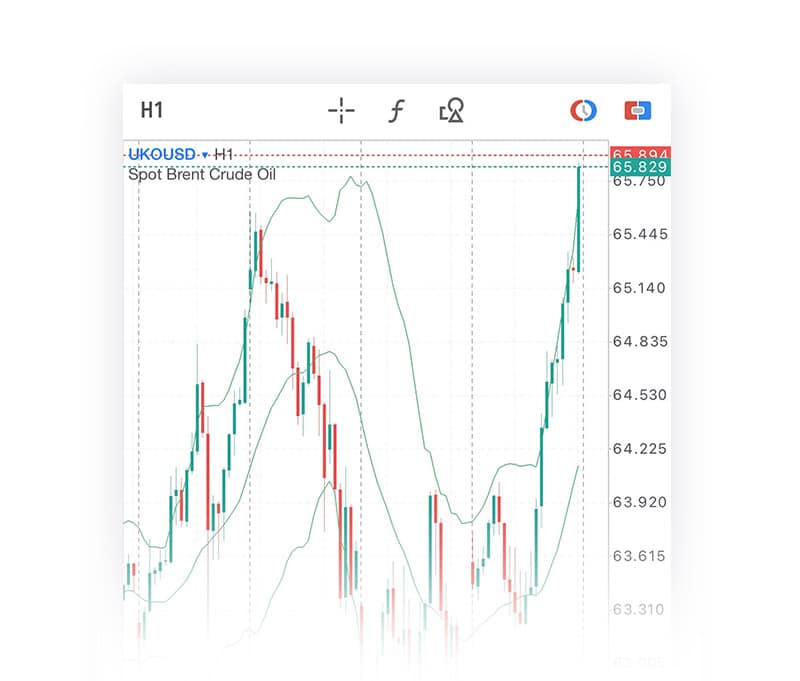

Commodities the clever way: ST5

With Golden Elephant you access commodity trading platforms among the most popular: ST5 . And using our ST5 Genesis platform and smart trading tools, you can track commodity prices in financial centres across the day. You can also set alerts to capture price movements, particularly around high-impact events like crude oil inventory reporting.

*With leverage both gains and losses are magnified. You should only trade if you can afford to carry these risks.

Range of Commodities

All Instruments

Below is the full range of commodity CFDs you can trade via our Golden Elephant trading platforms:

| Instrument | Symbol | Spread | Lot Size | Trading Hours (Platform time) |

|---|---|---|---|---|

| Spot Gold | XAU/USD | From 0.04 | 100oz | 01:01-23:59 |

| Spot Silver | XAG/USD | From 0.008 | 5,000oz | 01:01-23:59 |

| Copper Futures | COPPER-F | 0.004 | 25,000 lbs | 01:00- 24:00 |

| Spot WTI Crude Oil | USO/USD | Variable | 100 Barrels | 01:00-24:00 |

| Spot Brent Crude Oil | UKO/USD | Variable | 100 Barrels | 03:00-24:00 |

| US Oil Futures | USOil-F | Variable | 100 Barrels | 01:00-24:00 |

| UK Oil Futures | UKOil-F | Variable | 100 Barrels | 03:00-24:00 |

| Soybean Futures | SBEAN-F | Variable | 10,000 bushels | 03:00-15:45,16:30-21:20 |

| Wheat Futures | WHEAT-F | Variable | 10,000 bushels | 03:00-15:45,16:30-21:21 |

| Spot Natural Gas | NGAS | 0.013 | 10,000 MMBtu | 01:00-24:00 |

Integrated platform power

Golden Elephant

This powerful multi-asset platform lets you trade Forex, Shares and Futures as CFDs.

Learn more

GO WebTrader

A simplified ST5 version allowing you to access your trading account from your browser

Launch WebTraderGO trading in just a few steps

1. Confirm your identity

In just minutes we can verify your identity and create your account.

2. Fund account

Deposit a minimum of $200 from a debit card or bank transfer to start trading.

3. Place your trade

Take a position in your choice of instrument.

New to CFD Trading?

Extensive education

Golden Elephant ’ popular, highly-rated education programs and webinars can help all levels of trader.

Insightful news and analysis

Stay informed with news that directly impacts the Forex, Index and Commodity markets.

Trusted, regulated broker

Established in Australia in 2006, Golden Elephant is a trusted, regulated online CFD trading services provider.

About Golden Elephant